With so many fluctuating variables impacting their businesses right now, how can consumer product companies and retailers effectively forecast demand in the current market?

Supply chain constraints have eased, yet there are still backlogs, bottlenecks and a lack of resources/components needed to manufacture many goods and build up inventory for high demand items. At the same time, many manufacturers are saddled with aging, rapidly devaluing inventory that resulted from cancelled POs, missed shipment deadlines and port blockages during the pandemic. In many cases, that inventory is being stored in 3PL facilities, costing manufacturers tens to hundreds of thousands of dollars each month. Retailers, too, are grappling with excess inventory disposition issues.

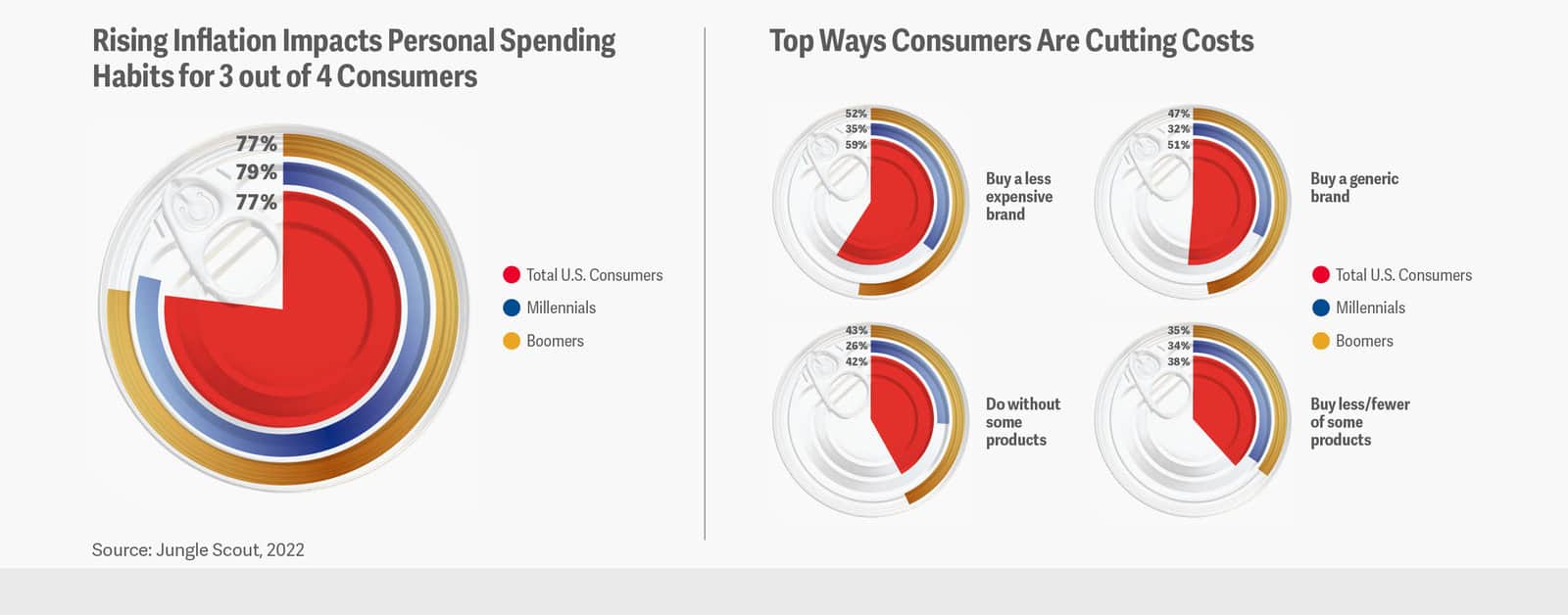

At the grocery, 73% of consumers surveyed say they have now acquired a taste for less costly private label/store brands and plan to keep buying them even as the economy improves, according to a study from consumer research firm, Attest. And this “trading down” trend isn’t limited to the just the food isles. TJX reported that sales at its HomeGoods unit dropped 7% year-over-year in Q1 of this year but that its Marmaxx business, including discount chain TJ Maxx, experienced a 3% sales increase.

Elsewhere, based on growing consumer traction for resale items on sites such as Thredup, Poshmark and others, retailers including American Eagle, J. Crew and Kate Spade have established curated second hand product offering on their websites. Could this trend expand to brick and mortar store floors and does it have the potential to impact upcoming order volume or influence the traditional composition of new items that retailers order from manufacturers moving forward?

What will tomorrow’s version of trading down to off brand products and buying resale at retail be? And how can traditional, decades-old demand forecasting models be expected to predict or adapt to such rapidly changing preferences quickly enough to serve manufacturers interests and profitability needs? The old mode of focusing on just the next three months no longer works under the changing rules of retail. What’s needed now are actionable insights that can help drive very well informed reorder point decisions looking out over periods that are more in the 18- to 24-month time range.

Fortunately, there are new, highly effective AI and other tools that can be leveraged to provide significant advance notice of advisable longer term action at the SKU level. Is the pink, size medium swing skirt selling out faster or slower than anticipated on its first day/week/month of availability and how does that inform reordering and future orders of similar items for next year’s season? Predictive size curves and return rates can now be built into forecasts. Automated notifications can be delivered via email or through a company’s internal communications platform when reorder authorization is needed, and domestic as well supplier country holidays can be factored in when calculating lead times on specific SKUs.

Real time refresh of inventory data now enable forecasts to be updated automatically with a high degree of accuracy, on a continuous basis. For those in the retail world (both suppliers and retailers), this means that a glance at the system dashboard at any time, on any given day, provides highly accurate inventory counts, and reorder recommendations based on up-to-the-minute conditions across multiple geographies and facilities.

Will the war in Ukraine end anytime soon? Will tensions with China and North Korea escalate? Will remote workers begin to return to offices in greater numbers? The existence of these and other variables, and how each ultimately plays out will have a distinct and notable impact on preference and traction in the retail channel this year and well into the future. For consumer product manufacturers and retailers alike, the time of formulaic, autopiloted forecasting of demand, guided by historic purchasing norms, is largely over. It is safe to say that those who are continuing to follow that past forecasting roadmap are likely already in some trouble.

What is needed now to help ensure future success is tailored application of business transformation expertise and the use of advanced tools to analyze highly current and actionable data (much of which can be extracted from the back end of a company’s own business systems) to derive new, timely insights and drive better informed decisions. This is the new formula for determining everything from what consumers will demand next and what customers will order most, to what raw materials, production capabilities, storage, shipping, and other resources a manufacturer will need to win in the market moving ahead.

With a half century of management and financial consulting experience, Getzler Henrich has achieved great success in helping enhance the processes needed to achieve the aggressive growth targets of healthy businesses. Because every client’s situation is urgent, our approach to decision making and implementation is rapid and pragmatic. Each engagement begins with a diagnostic phase, and, based on our findings, we set realistic action steps to improve the company’s operational and financial performance, enhance its enterprise value and maximize stakeholders’ recoveries. Often we assume direct responsibility for implementing the action plan. In every case, we commit ourselves to doing what it takes to complete the assignment successfully. We encourage you to contact our team to discuss your or a client’s situation today. We are here to help.