In this second article in our two-part series on the rapid and unpredictable evolution of the automotive industry, we discuss the identification of signs of distress in automotive suppliers that can help advisors and lenders recognize challenges earlier so issues can be addressed early, before crisis sets in.

Introduction

Distress is an inherent part of a company’s lifecycle. Effectively managing and preemptively addressing this stress is vital to avoid bankruptcy, maintain worker productivity, and sustain the overall economy. This is especially critical in industries like automotive, which rely on extensive supply chains with interdependent vendors. To ensure the company’s success, managers lenders and advisors should be well-versed in recognizing the common signs of distress and taking proactive measures to steer the company towards growth.

Early Indicators

There are several early indicators that serve as red flags. Slowing sales over a prolonged period, particularly during an upturn in the market and when competitors thrive, demand immediate attention. Consistent volume swings also suggest pricing issues that can significantly impact manufacturing. These factors, if left unaddressed, can lead to more detrimental problems, including deteriorating margins, delivery, and quality issues, and even workforce reduction. While these issues can manifest in various ways, it is essential to read and be able to interpret financial metrics to fully understand the severity of the potential problems. Breaching covenants can escalate the situation rapidly.

Sales Demand

Slowing sales demand careful scrutiny. For mature firms, flat sales on a seasonally adjusted basis generally pose no immediate danger. However, sustained sales decline requires action to prevent further issues such as sales declining below the minimum required to cover fixed costs. A business with a traditional annual revenue in the range of $100M cannot cover fixed costs (e.g. rent, salaries or utilities) when that revenue drops to $60M. The lack of revenue will eliminate profits. Possible steps include: increasing revenue with existing or new customers or re-sizing the business to operate efficiently at the lower revenue.

Unusual volume swings pose a management concern. Various factors can cause these fluctuations, some of which may be typical for the industry. July and December shut down periods predictably impact revenue in the automotive industry. . To mitigate their impact, companies should address the root causes and develop comprehensive plans. Unrealistic customer expectations and conflicts between sales and operations are common culprits. Additionally, failure to anticipate sudden schedule changes for influxes or drops in demand can exacerbate the situation.

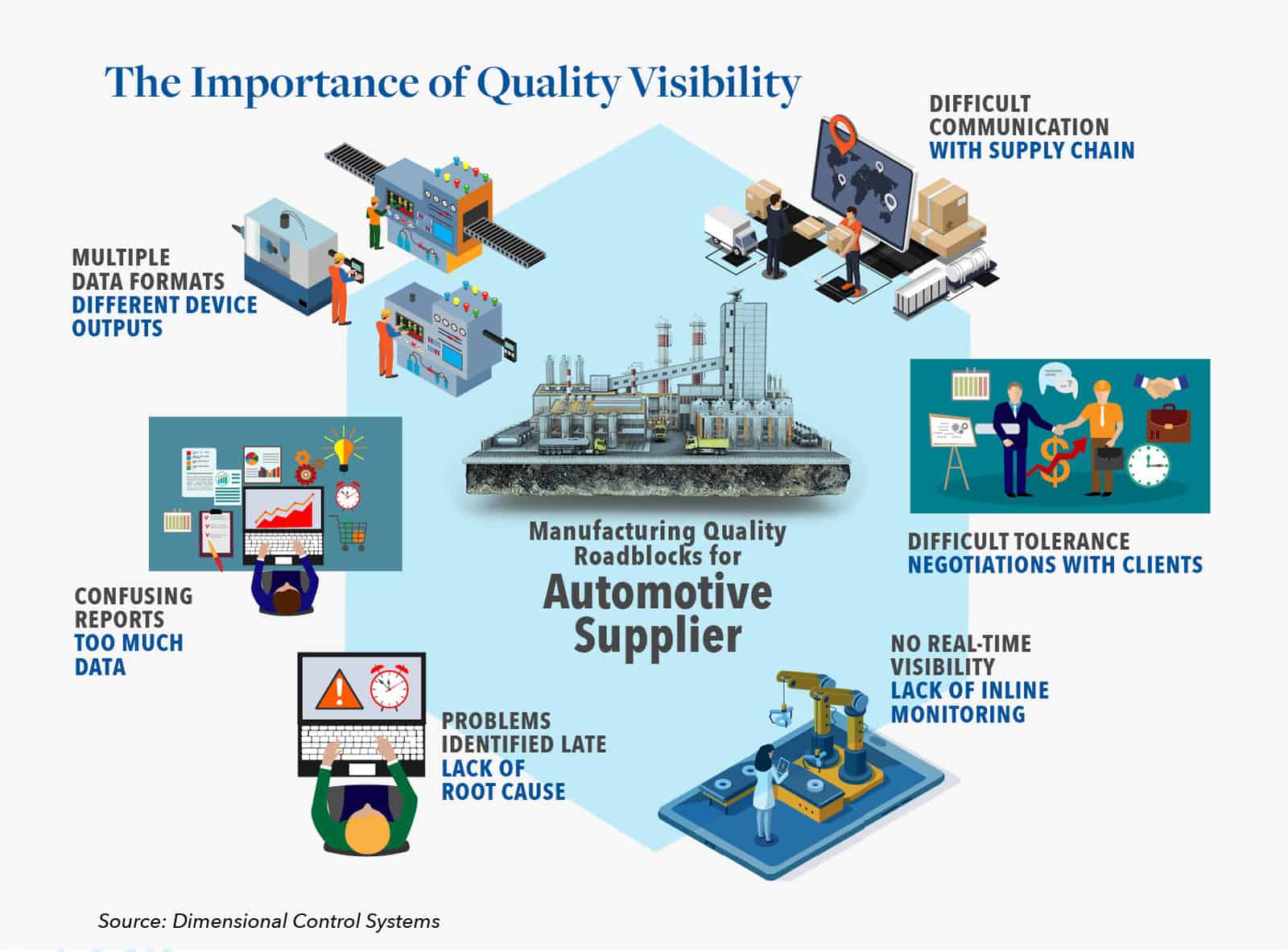

Delivery & Quality

Delivery and quality issues, which often intertwine with the aforementioned problems, are commonly observed operational challenges that can lead to distress and the resulting customer dis-satisfaction may be the root cause for sales volume declines. Large order requests within a short timeframe can force firms to prioritize quantity over quality, compromising product excellence. This may also disrupt shipping plans, leading to non-standard shipping, delayed orders, and subsequent cash flow issues. Firms sometimes feel pressure to cut corners when they take business with low margins, this can drive firms to cut costs or capital expenditures, impacting production quality and delivery reliability.

Conversely, producing products with quality issues or facing consistent delivery problems can lead to customer dissatisfaction, remakes, or customers switching to alternative suppliers. This can result in declining sales and margins. Resolving these issues involves examining scrap rates, implementing preventative maintenance, and considering capital expenditures, including increased automation. However, implementing these solutions can be costly, and if a company is struggling with other operational aspects, generating the necessary funds can be challenging. Seeking external expertise becomes invaluable in managing debt within covenant limits and effectively addressing operational issues.

Margin Deterioration

Clearly deteriorating margins stand out as a lagging indicator of significant trouble. Apart from declining sales, this issue severely affects a company’s health for several reasons. It erodes EBITDA, increases the working capital required to run the firm, and creates an unhealthy mix that can push a company towards covenant breaches and increased debt. Diagnosing the problem involves asking critical questions, such as the reasons behind the deterioration, the duration of the issue, and identifying the customers responsible for the decline. Armed with this information, managers can develop plans to rectify the situation and address the fallout. If financial metrics indicate emerging issues and encroachment on covenant breaches, seeking external advice becomes crucial to manage cash flow and right-size the company.

More Issues Lurk Beneath the Surface

It is important to recognize that these warning signs often lead to additional issues within the company. One significant knock-on effect is a shrinking workforce. When sales decline or margins contract, managers may consider downsizing the workforce to align with company needs. However, this can be a symptom of an underlying problem. Additionally, workers may leave due to a pessimistic outlook resulting from declining margins or other issues mentioned earlier. Moreover, high volume swings may require the use of temporary labor to meet customer demands. This can increase training costs and lower morale among temporary workers who have limited opportunities for advancement. Ultimately, these issues can impact plant culture, creating a tense work environment that perpetuates a negative cycle of distress.

Importance of Financial Metrics

Financial metrics act as vital indicators of a company’s struggle before it becomes a serious issue, particularly as banks and institutions rely on this information for covenants. Important ratios and judgment-based factors must be monitored. Soft metrics, such as customer and supplier concentration, hold significant relevance in the manufacturing space. Overly concentrated customers can expose the company to aggressive market downturns, leading to volume swings, slowing sales, and margin deterioration. Similarly, supplier concentration can cause delays in inputs, resulting in delayed orders and the need to find alternative suppliers. These issues can bring underlying problems to the forefront.

Formal financial metrics that warrant close attention include EBITDA, debt to EBITDA, debt to revenue, and the current ratio. EBITDA below 6% indicates inadequate cash flow for future profitability. While standard EBITDA margins across the S&P 500 reach around 15%, the manufacturing sector, especially at the middle market level, typically achieves around 10% for a healthy company. Evaluating debt to EBITDA ratio provides insights into cash flow, with a ratio exceeding 3.5 to 1 indicating an unfavorable position to repay debt, raising concerns for investors and banks. Similarly, a debt to revenue ratio exceeding 1:2 implies inadequate revenue to support a high debt burden. Lastly, the current ratio, reflecting the ratio of current assets to current liabilities, should not drop below 2:1, indicating an inability to settle immediate liabilities and making suppliers and banks cautious about extending further credit. The presence of one or more of these indicators signifies business struggle, demanding immediate corrective action.

Addressing Weaknesses and Building Resilience

Effectively managing and addressing distress signals in a company is vital for its survival and the broader economy. Industries with intricate supply chains, such as automotive, are particularly vulnerable. Slowing sales, volume swings, deteriorating margins, delivery and quality issues, and a shrinking workforce are common warning signs. Financial metrics, including EBITDA, debt ratios, and the current ratio, play a crucial role in identifying and resolving these issues. Taking prompt action, such as analyzing operations, adjusting pricing strategies, seeking external advice, and implementing necessary changes, is essential. By proactively managing these indicators, companies can navigate through distress, maintain their operations, and ensure long-term sustainability.

Given the evolving landscape outlined above, we urge suppliers across the automotive industry to undertake a “health check,” leveraging the independent and unbiased services of a qualified and experienced third party consultant. Closely reviewing financials, operations and identifying potential inefficiencies or problems that may not otherwise be obvious to those within the business, should be considered as a risk mitigation best practice– even if a company is performing well.

Conclusions

Hilco Performance Solutions and Getzler Henrich, both collectively and independently, have recently conducted numerous such heath checks on behalf of a wide range of supplier companies across the automotive and other industries. In addition to aiding those businesses to: 1) better balance leverage and margins in negotiations with OEMs, 2) focus more clearly on financial metrics and performance during the bidding process, 3) further diversify their offerings and expertise to align with the evolving market and, 4) develop a robust strategy to navigate regulatory uncertainties, these efforts have provided our teams with key learnings and insights that we are now able to bring to clients on new engagements as well. With this in mind, and the impacts of the still pending UAW negotiations a continuing uncertainty, we encourage you to reach out to us today. We are here to help.

About Hilco Performance Solutions

At Hilco Performance Solutions, we help companies simplify and streamline business processes and improve operational efficiency, enabling them to remain competitive and gain market share in an increasingly interconnected economy. Leveraging a highly tenured team of cross-functional experts in the areas of operations, supply chain, people, mergers & acquisitions and commercial, we advise clients toward sustainable revenue growth and cost reduction.

About Getzler Henrich & Associates

As a pioneer in the turnaround and restructuring space, we’re tuned in to the objectives and sensitivities of all parties and help companies identify and work toward the best solutions. It is in that context that we provide a full array of turnaround, workout, crisis and interim management, corporate restructuring, bankruptcy, financial advisory and distressed M&A services to publicly held companies, private corporations and family-owned businesses worldwide.