REAL ESTATE & HOSPITALITY

The Real Estate sector is facing headwinds due to higher interest rates and the significant increase in employees working from home. While conditions can vary widely depending on asset class, market, and sub-market, generally they are challenging: higher cap rates, tighter lending standards, more expensive financing and conservative LTVs, and higher operating costs. The office asset class has been most heavily impacted by the current environment, but other asset classes have been affected as well, including multifamily and hospitality.

The hospitality market and industry has recovered significantly from the depths of the COVID-19 pandemic, with many markets and segments having reached or exceeded 2019 RevPAR. However, the recovery has been driven by ADR growth as well as voracious domestic consumer demand for travel, as transient business travel and foreign tourist travel have not recovered to 2019 levels. Some segments are still struggling, such as full-service hotels in downtown business districts. Higher operating costs (labor, insurance and utility costs) have eroded margins, and labor shortages have left many properties struggling to recruit and retain employees, impacting guest satisfaction. Many properties have delayed needed PIPs and are now facing pressure from franchisors and guests to implement them. However, higher interest rates and construction costs, as well as tighter lending standards, have made it difficult for owners to finance these projects. Hospitality owners and management companies must adapt to a rapidly evolving landscape and address current challenges while satisfying their guests – these are the priorities for those seeking to thrive in the hospitality industry.

Our Range of Services Includes:

- Bankruptcy Advisory

- Fiduciary Services

- Financial Advisory (Workouts, Restructuring, Business Plan Analysis, Liquidity Management)

- Interim Management

- Lease Restructuring

- Litigation Support / Expert Testimony

- Note Sales

- Property Sales & Dispositions

- Tax Advisory Services

- Transaction Advisory Services (Appraisals, Due Diligence)

Case Studies

- Financial Advisor to The Williamsburg Hotel, a full-service 147 room independent hotel. GH was retained during the bankruptcy case to assist the debtor and its professionals in developing a Plan of Reorganization and providing related expert witness support. Since the tenor of the bankruptcy case mirrored the contentious pre-petition relationship between the debtor and the lender, GH also assisted the debtor in responding to various motions filed by the lender and the United States Trustee, including motions to convert, appoint a trustee, and appoint and examiner. During the course of its retention, GH assisted the debtor in developing plan projections, prepared expert reports and participated in depositions related to the plan. In addition, GH performed a forensic analysis of certain pre-petition transfers to/from the debtor and provided court testimony related to the findings. Ultimately, the court approved a motion to appoint a Chapter 11 trustee, and tasked GH, in conjunction with the CRO, to obtain control of cash and transition the control of the hotel to the Chapter 11 trustee.

- Chief Restructuring Officer of Metroplex on the Atlantic, LLC., a privately held real estate company whose primary asset was a 130-unit apartment building. Taking over from a receiver, GH was retained during the bankruptcy process to guide the company through confirmation of a plan in an adversarial situation and implement the plan post-confirmation. GH guided the company through a successful §363 sale process and testified during the contested confirmation hearing to successfully confirm the plan. Subsequently, GH served as Plan Administrator and monetized remaining assets, reconciled claims, made distributions to creditors, and wound down the estate.

- Financial Advisor to a publicly traded SPAC. A SPAC was seeking to acquire a group of real estate investment funds that invested in hotel, multifamily, office, self-storage and residential assets and retained GH, in conjunction with Hilco Global, to conduct due diligence on the planned transaction. The scope of work included analysis of the operating forecast and underlying assumptions, reported and adjusted EBITDA, revenue recognition policies, and the underlying real estate assets.

- Litigation Support/Expert Witness. GH was retained by the owner of a multifamily property to opine on the commercial reasonableness of the UCC sale of the property to support a temporary restraining order and preliminary injunction, which bought the owner time to pursue a refinancing of the property.

Articles

- Unstable Foundations: Multifamily Real Estate’s 2024 Reckoning

- What to Expect in the Hospitality Industry in 2024

- The Journey from Empty Urban Offices to Residential Solutions Is a Complex Path

- From Closure to Conversion: Real Estate’s Role in Shaping Post-Closure University Destiny

- A Look at the Current Student Housing Market

- Hybrid Work is Here to Stay, So What Should Owners Do?

- What to Expect in the Hospitality Industry in 2023

- Operational and Financial Issues in the “Great Reopening”

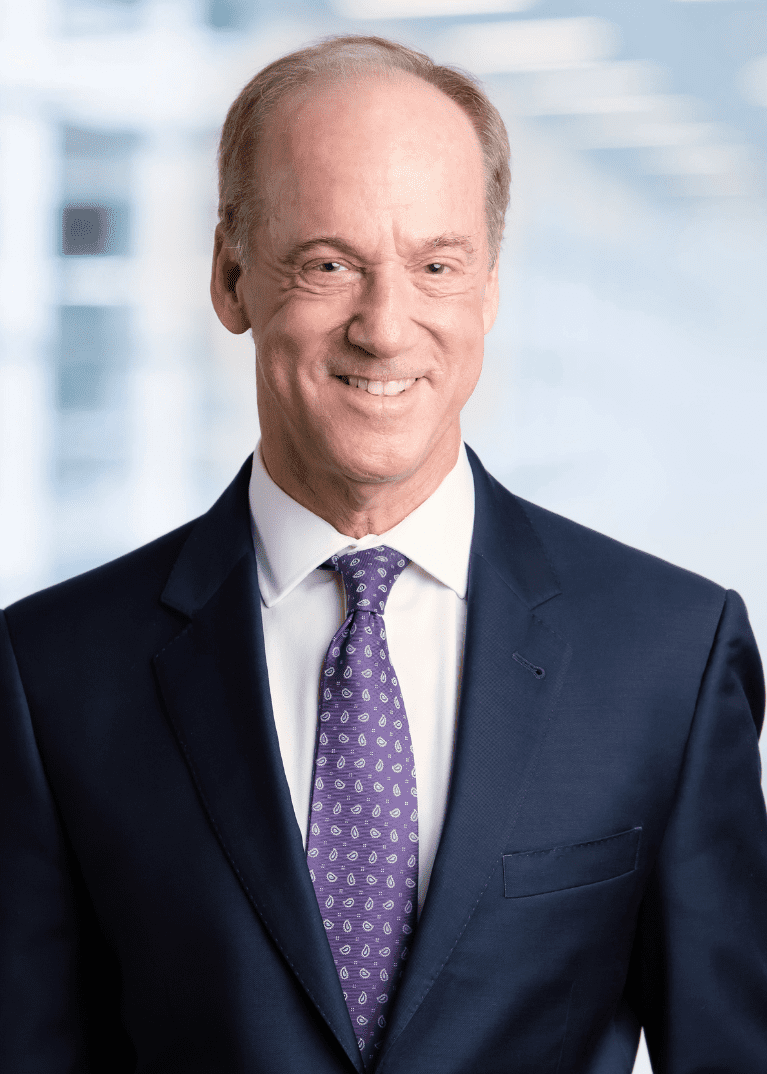

Team